Use cryptocurrencies: Beginner guide to trade effective orders

Cryptic trade has become more popular in recent years, and many people and institutions are trying to use the volatility of cryptocurrency. One of the key aspects of successful cryptom trade is the effective use of limit orders. In this article, we examine how to use limit orders in the cryptom trade, including when to place them, what types of orders are best for different market conditions and tips to maximize profits.

What are border ordering?

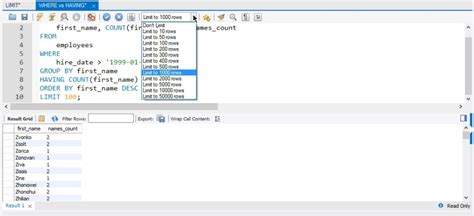

A limited order is an automated order to purchase or sell a particular currency at a predetermined price. The most important difference between a regular command and a limited command is that the order is only made if the market reaches the necessary price. In other words, the quoted limit order starts to buy (long) if the price falls below a certain level or sold (short) if it rises above another level.

When to use your Crypto -trading Limit orders

Limited orders can be particularly useful for many reasons in trade with cryptoms:

- Risk Management : If you stop a STOP order at a specific price, you can limit the potential loss if you move against the market.

- Speculation : Limited orders allow you to enter positions when you think a particular cryptocurrency is to increase prices.

- Discovery Prices : You can use limit orders to buy or sell cryptocurrency to predict future prices.

Types of border order

There are many types of limit orders, each of which has its own benefits:

- Order of the Purchase Border (SL) : The highest possible price on which you are willing to buy a cryptocurrency.

- Order of Sales Limit (TP)

: The lowest possible price is willing to sell a cryptocurrency.

- Limic image Stop-Loss (SLO) : A point in which your position is automatically closed when it falls below the set price.

When to enter limit orders

Follow the following instructions to maximize profits using limit orders:

1.

- Orders of Sales Limits : If you have a short (betting) cryptocurrency and you want to close some profits or use a bear trend.

Tips for Effective Trading with Limited Orders

If you want to get the most out of your human trafficking strategy, don’t forget the following tips:

1.

- Define realistic prices : Orders only restrict orders if they understand market trends and potential prices firmly.

- Pay attention to the market : Take care of cryptocurrency prices, messages, and economic indicators to modify your situation accordingly.

- Do not target : Be careful not to use too many arm effects in each store (borrowed money) as this may increase losses if the market moves against you.

Example of scenario

Suppose we trade with bitcoins and our broker offers a $ 40,000 shopping limit. If we believe that cryptocurrency prices increase as a result of increased institutional interest or improved regulatory support, we enter the purchase limit. If the price falls below $ 38,500, the STOP order will be automatically activated, which prevents you from selling your long position.

Conclusion

Limited orders are an effective tool in crypto traffic that allows you to manage risk, speculate market trends and execute stores at a predetermined price. Understanding when you need to effectively use limit orders and compliance with successful implementation, you can potentially maximize your profits in the world of cryptoms.